In a recent development that sent shockwaves through the financial and cryptocurrency sectors, Trump Media is reportedly engaged in “advanced talks” to acquire Bakkt, a cryptocurrency trading firm. This news was broken by the Financial Times, citing sources close to the negotiations. The immediate aftermath saw a remarkable surge in stock prices for both entities involved, highlighting the volatile intersection of politics, technology, and finance.

Immediately following the Financial Times report, shares of Trump Media, which is largely owned by former President Donald Trump, experienced a sharp increase, skyrocketing by over 16%. This surge is indicative of how intertwined political narratives can significantly impact financial markets. Bakkt also experienced an extraordinary jump of more than 162%, leading to multiple trading halts as a result of volatility, showcasing the rapid and sometimes reckless nature of investor sentiment in the crypto market.

The involvement of prominent figures such as Kelly Loeffler, former CEO of Bakkt and a member of Trump’s inauguration committee, adds another layer of complexity to this acquisition. Loeffler’s connections extend to the Intercontinental Exchange, which owns the New York Stock Exchange, raising questions about the implications of such intertwining relationships in business dealings, especially in politically charged environments.

Despite the ostensible growth in market value, Trump Media has faced significant operational challenges, previously reporting a staggering net loss of $363 million against a meager revenue of $2.6 million. Such figures evoke skepticism regarding the sustainability and viability of this media venture, particularly when juxtaposed against a market capitalization exceeding $7 billion. This anomaly can potentially be attributed to the speculative nature of retail investors, eager to ride on the political coattails of Trump’s potential comeback in the 2024 election. However, claims of substantial cash reserves, nearing $673 million, may provide a cushion for ongoing operations and future ventures.

Similarly, Bakkt has struggled to establish a stable financial footing since its inception in 2018. Although it reported total revenues nearing $328.4 million in its latest fiscal quarter, it also acknowledged an operating loss of $27.4 million. The company’s precarious financial state was further highlighted by concerns regarding its status as a going concern, leading management to admit that they may face challenges in the future. Such financial distress could complicate Trump’s negotiations and alter perceptions regarding the desirability of the acquisition.

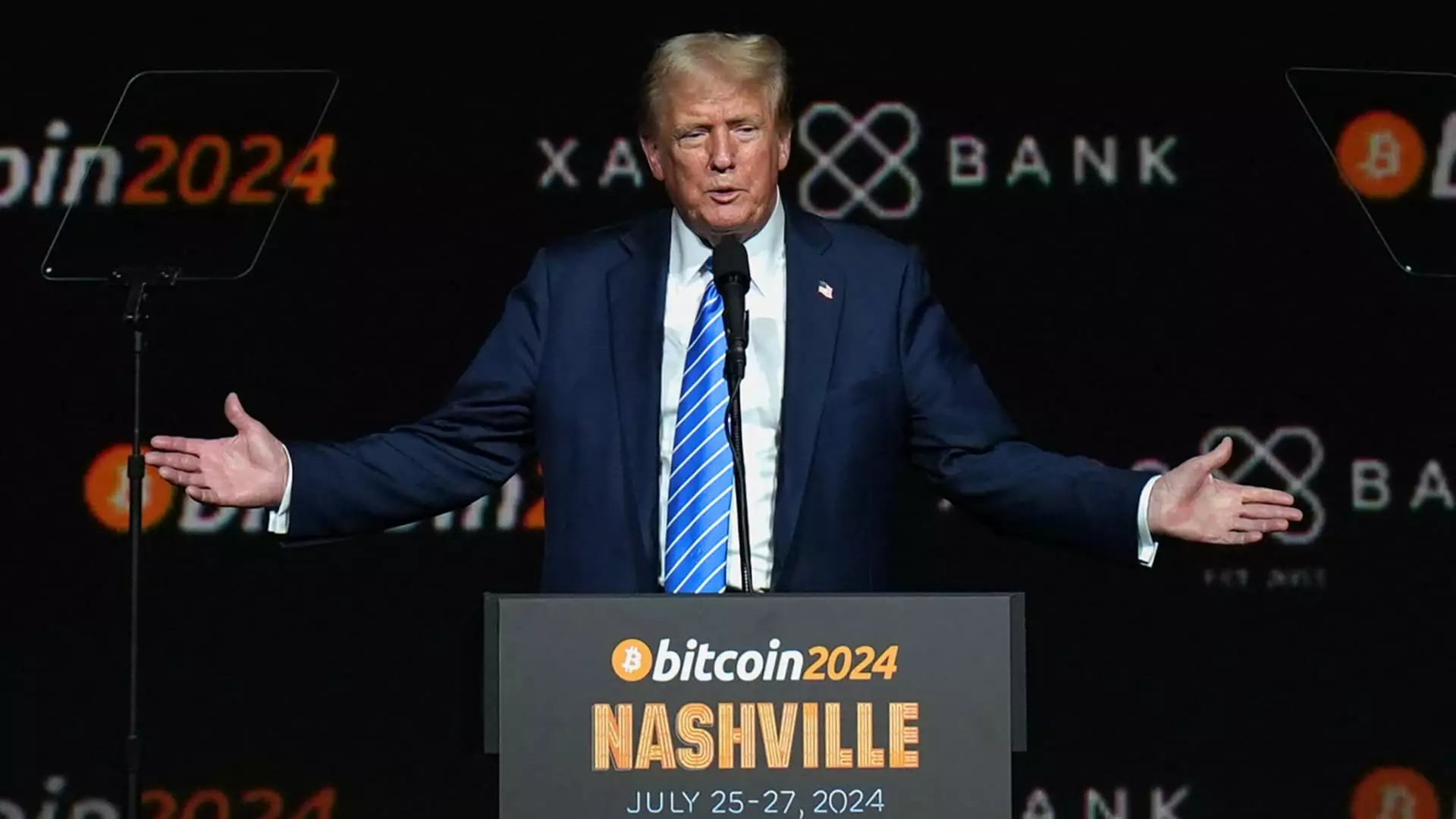

Trump Media’s possible acquisition of Bakkt raises significant questions about the nature of the cryptocurrency market and its relationship to established financial systems. As Trump steps back into a role of political power, the confluence of his business interests with emerging technological sectors could herald a new era where politics and cryptocurrency become increasingly interlinked. Just weeks prior to the presidential election, he launched a token connected to a new crypto venture, World Liberty Financial, indicating a strategic pivot toward leveraging crypto assets.

This move could indicate a deeper strategy by Trump to harness the potential of cryptocurrency, not just as an investment opportunity but as a means of securing financial influence in the expanding digital economy. Further complicating matters, Trump’s proposed deal with World Liberty Financial suggests he and his family could claim a substantial share of profits while avoiding associated liabilities, raising ethical questions about accountability and management in high-stakes business endeavors.

Ultimately, the potential acquisition of Bakkt by Trump Media is emblematic of the unique and often turbulent intersection of politics, finance, and technology in today’s world. It invites speculation on the future of cryptocurrencies under political leadership and the volatile nature of such investments. As the landscape shifts and evolves, stakeholders will need to navigate these turbulent waters with caution, recognizing the profound implications these developments could have on both the cryptocurrency market and the broader economy.

Leave a Reply