Political prediction markets have emerged as a fascinating intersection of finance and democracy. These platforms allow individuals to wager on electoral outcomes, thereby providing a financial incentive to maintain the integrity of the predictions made. Recently, one platform, Polymarket, has announced its intention to reinstate operations within the United States after a brief hiatus and a substantial financial penalty related to regulatory issues. This shift not only highlights the evolving landscape of political betting but also raises questions about the accuracy and reliability of such predictions compared to traditional polling methods.

Polymarket’s previous suspension of U.S. services followed legal challenges posed by the Commodity Futures Trading Commission (CFTC). The CFTC’s requirements for registration and compliance have often limited the growth of prediction markets in the U.S. However, a recent ruling by the U.S. Appeals Court has signaled a potential turning point. By lifting restrictions on a competitor, Kalshi, the court’s decision underscores a growing recognition of the legitimacy of political prediction markets. As Shayne Coplan, the founder of Polymarket, articulated in a live television interview, the legalization of these markets represents a significant victory for advocates pushing for the expansion of such platforms.

The challenges faced by Polymarket and others in this sector illuminate the complexities of regulatory frameworks governing financial markets. As these platforms strive to comply with legal obligations, they must also innovate to attract users increasingly skeptical of traditional polling. With the market now poised for resurgence, the potential for rapid growth in participation is substantial.

Polymarket’s resurgence comes at a time when major financial services, including Interactive Brokers and Robinhood, are beginning to enter the prediction market space. Their involvement suggests a recognition of the predictive power these platforms hold compared to traditional methods like opinion polling. As users engage with these markets, their financial stakes provide a compelling motivation for accuracy. According to Robinhood CEO Vlad Tenev, the financial implications of participating in these markets make them more compelling than simple surveys, as they reflect a broader societal investment in electoral outcomes.

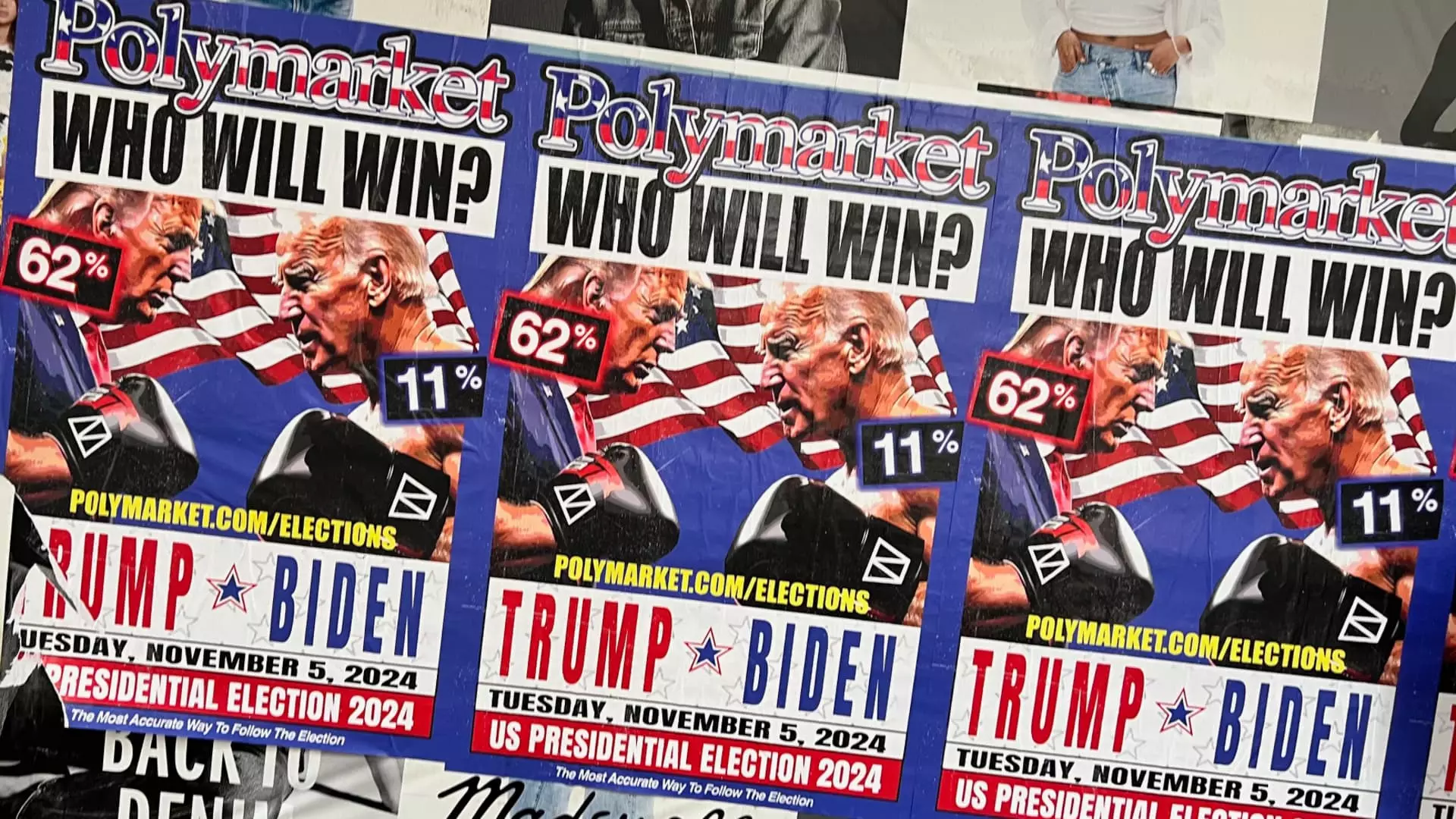

The remarkable swing in prediction market activity during the recent presidential election serves as a testament to this concept. A reported trading volume nearing $3.7 billion on Polymarket alone showcases the platform’s influence and users’ newfound confidence. The combination of financial incentives and active user engagement appears to create a more dynamic and potentially accurate means of gauging public sentiment regarding elections.

The recent electoral dynamics have also seen influential figures, such as Elon Musk, weighing in on these prediction markets. His endorsement of Polymarket—stating that it proved more accurate than polls—highlights the growing acceptance of these platforms as reliable indicators of political sentiment. Musk’s views resonate with those who believe that betting markets encapsulate a collective intelligence that can often surpass traditional polling methodologies.

As the 2024 presidential race approaches, the question remains whether prediction markets will continue to gain traction and whether they will be seen as legitimate tools for forecasting electoral outcomes. The belief that real monetary investment produces more reliable results reveals a shift in how we perceive public opinion and its documentation in the digital age.

As Polymarket looks to re-enter the American market, it embodies a transformative moment for political participation. The growing acceptance and potential normalization of prediction markets could redefine how society approaches electoral processes. With significant opportunities ahead, the convergence of financial markets and political forecasting may pave the way for a more engaged and informed electorate. In the coming years, we may witness these platforms not only participate in political forecasting but also influence public discourse regarding elections and policy-making at large. The evolving relationship between finance and governance stands to reshape our understanding of democracy itself—bringing a new dimension to the vote.

Leave a Reply