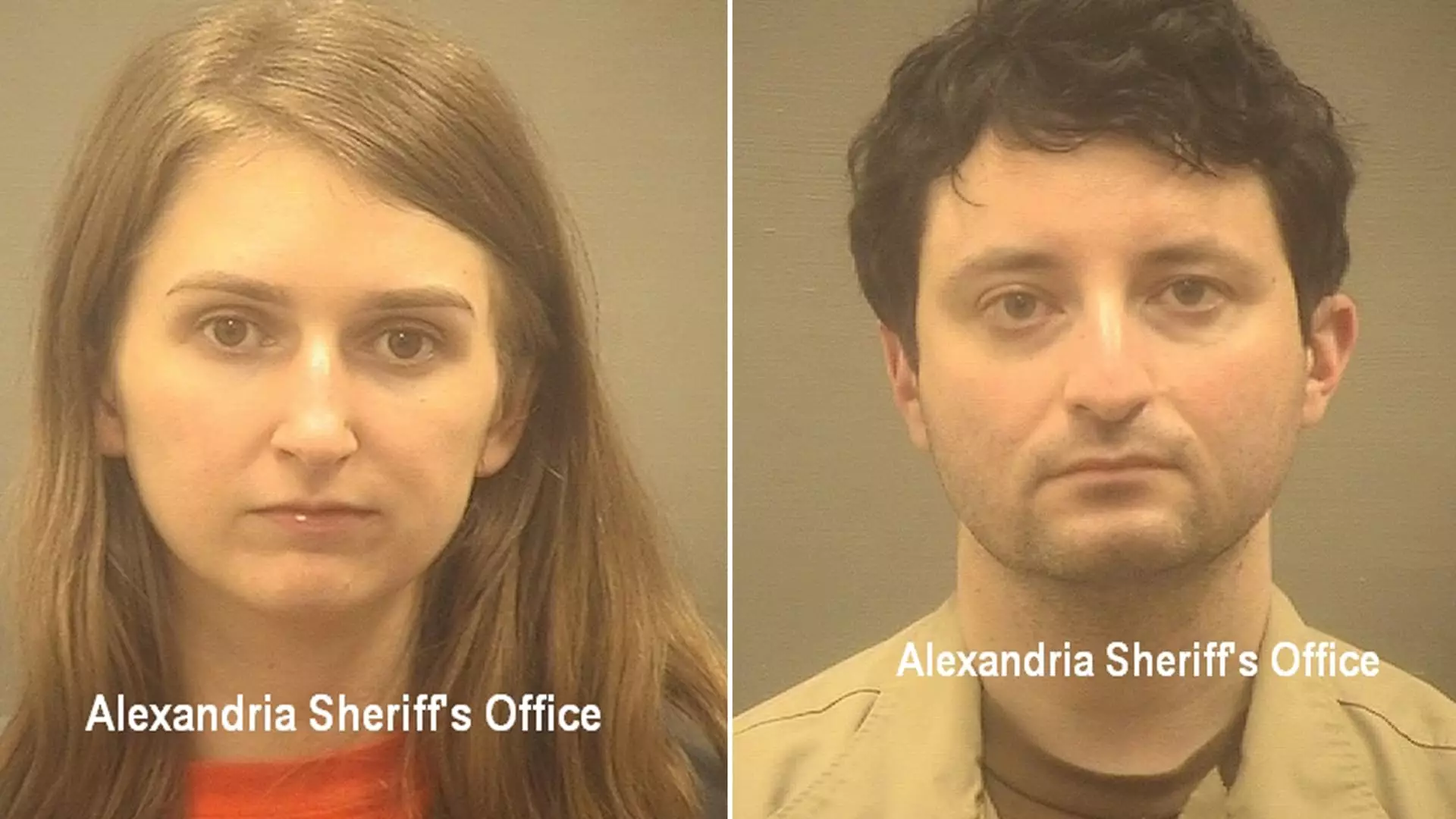

The cryptocurrency world has been no stranger to dramatic events, but few stories are as intriguing—or, indeed, disturbing—as that of Ilya Lichtenstein and his wife, Heather Morgan. This episode marks one of the most significant thefts in the history of cryptocurrency and offers an illuminating example of the complex intersection between digital assets and criminal activity. What began in 2016 as a high-stakes heist ended with Lichtenstein facing a prison sentence, raising questions about the effectiveness of regulations and law enforcement in the fast-evolving landscape of cryptocurrencies.

In 2016, the Bitfinex exchange was compromised, leading to a staggering loss of nearly 120,000 bitcoins. At the time of the hack, the value of the stolen crypto assets was around $70 million, a relatively small sum considering the magnitude of the theft. However, as the price of Bitcoin skyrocketed over the next several years, that same quantity of digital currency ballooned in value to an astonishing $10.5 billion by the time of the sentencing. This discrepancy highlights a fundamental issue within the cryptocurrency market: volatility can turn fleeting moments of financial crime into life-altering fortunes, for better or worse.

Ilya Lichtenstein orchestrated more than 2,000 unauthorized transactions in his cyberattack, demonstrating not only technical prowess but also a blatant disregard for the law and the ethical implications of his actions. His methodical unraveling of Bitfinex’s security defenses reminds us of the potential vulnerabilities in even the best-established platforms.

Unfortunately for Lichtenstein, the thrill of the hack would not last long unscathed. Along with his wife, he devised a sophisticated money laundering operation to disguise the origins of the cryptocurrency they had stolen. During his plea hearing, Lichtenstein was labeled by prosecutors as “one of the greatest money launderers that the government has encountered in the cryptocurrency space.” This notoriety sheds light on the mounting challenges that law enforcement agencies face in cracking down on cryptocurrency-related crimes.

Eighteen months after their arrest in New York, both Lichtenstein and Morgan pleaded guilty to conspiracy to conceal and launder the proceeds of crime. The complicity of his wife in the scheme—described as a “lower-level participant”—raises intriguing questions about shared responsibility in criminal enterprises and the extent to which individuals may become entangled in illegal activities. Prosecutors are seeking a prison sentence of 18 months for Morgan, reflecting a perceived disparity in their roles in the conspiracy.

Fast forward to Thursday’s sentencing, where Lichtenstein received a five-year prison term along with three years of supervised release—sentences determined under the advice of prosecutors. His full acceptance of responsibility was made clear, as he stated, “I want to take full responsibility for my actions and make amends any way I can.” Such a statement, while somewhat poignant, raises questions about the sincerity of remorse among criminals—especially those who stood to gain so significantly from their misdeeds.

What should not be overlooked is the importance of restitution in these cases. Following Lichtenstein’s sentencing, the government indicated an optimistic intent to return most of the seized cryptocurrency to Bitfinex and possibly to other affected stakeholders. This potential restitution could serve as a first step towards healing within the crypto community, demonstrating that while losses can be monumental, avenues for recovery may still exist.

The unfolding of this saga is not just about punishing individual criminals; it also speaks to the broader issues within the cryptocurrency world. With ever-evolving technologies and in the face of sometimes inadequate regulations, incidents like these highlight the need for a more robust framework to mitigate risks associated with cryptocurrency trading and exchanges.

As Lichtenstein’s case concludes a chapter in the ongoing narrative of cryptocurrency legitimacy and ethics, it also illustrates the precarious balance between innovation and regulation. If history has taught us anything, it is that crypto enthusiasts and regulators alike must remain vigilant. Only through cooperation, education, and diligent enforcement can the cryptocurrency ecosystem hope to curtail illicit activities while still fostering an environment conducive to legitimate growth and technological advancement.

Leave a Reply