The stalled bid of Nippon Steel for U.S. Steel has underlined the intricate web of national security considerations, international corporate relations, and labor politics in the United States. The Biden administration’s recent decision to extend the timeline for this contentious $14.9 billion acquisition until June 2025 is indicative of a larger narrative where global investments collide with domestic policy concerns. In this article, we will unpack the implications of this protracted affair, exploring its potential effects on the steel industry, U.S.-Japan relations, and the American labor market.

The National Security Quandary

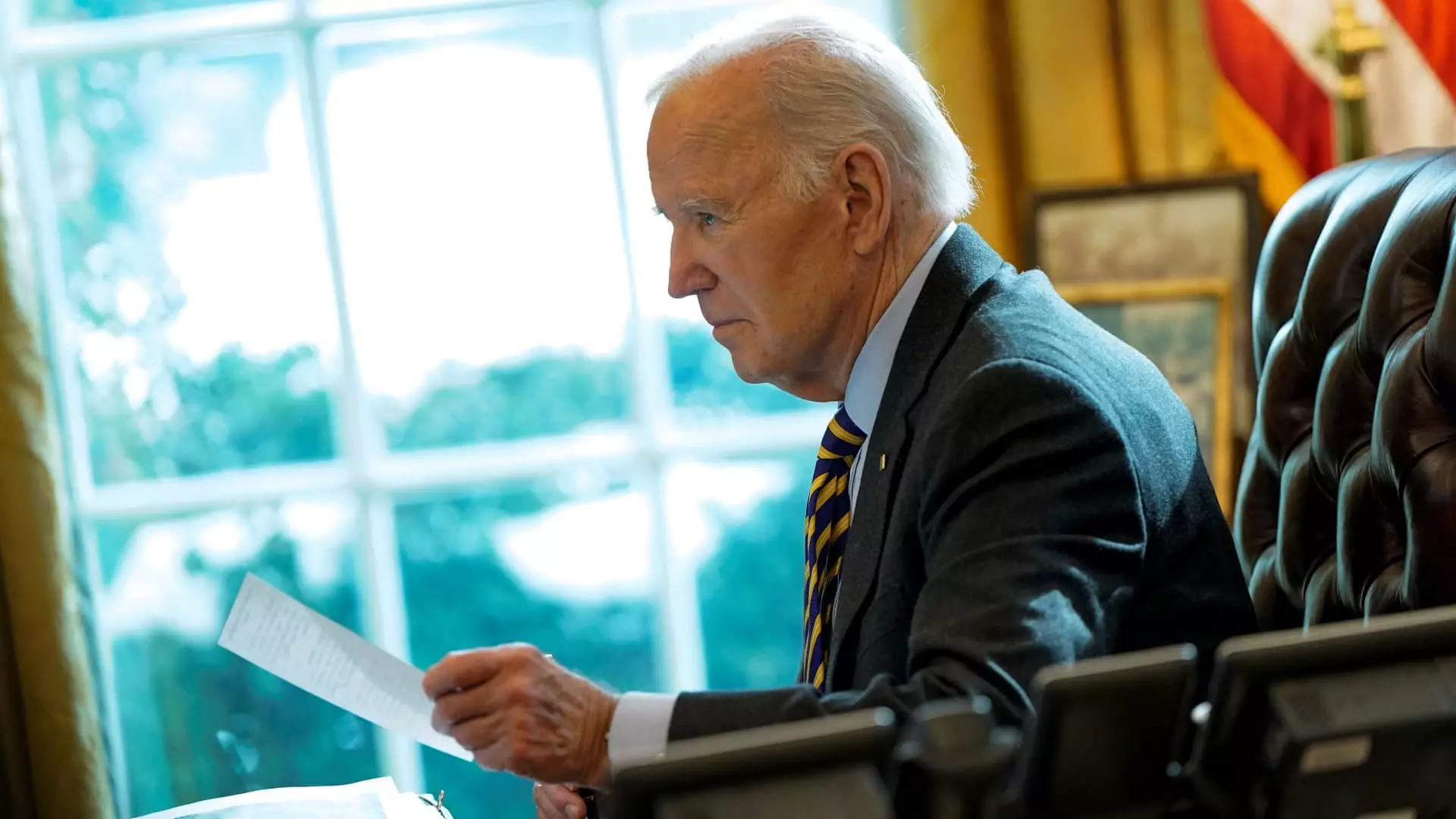

When President Biden blocked the acquisition on January 3, citing national security grounds, he ignited a debate that is not merely about steel but rather about the very fabric of American industry. The Committee on Foreign Investment in the United States (CFIUS) undertook a thorough examination of the acquisition, reflecting the administration’s cautious stance on foreign ownership of strategically essential sectors. National security concerns are paramount in decisions affecting industries that are foundational to the U.S economy and military readiness. The current environment has profoundly impacted foreign companies seeking to invest in U.S. companies, raising legitimate questions regarding the balance between economic growth and security.

The political backdrop surrounding this acquisition further complicates its narrative. Both Biden and his predecessor, Donald Trump, had aligned their endorsements with labor interests, particularly the United Steelworkers union, which has openly opposed the merger. This bipartisan consensus indicates that the issue transcends party lines; it is deeply embedded in the national psyche regarding job security and the historical understandings of American manufacturing strength.

Once the executive order was solidified, U.S. Steel and Nippon Steel quickly challenged the ruling in court, arguing that the CFIUS review was biased due to Biden’s known opposition. This legal pushback raises vital concerns about corporate governance in the context of government scrutiny. The successful navigation of regulatory frameworks is critical for multinational corporations as they strive to pursue mergers and acquisitions. The court’s impending review could serve as a bellwether for how similar cases will be managed in the future, potentially altering the trajectory of foreign investment in the U.S.

Moreover, the court’s involvement may lead to a reassessment of how CFIUS conducts reviews, highlighting a need for transparent processes that render fair evaluations of foreign investments regardless of political affiliations or public sentiment. Should the court rule in favor of Nippon Steel and U.S. Steel, it could set a precedent that emboldens further foreign investments, especially from allied nations like Japan.

The implications of this acquisition dispute extend beyond economics into the realm of diplomacy. Japanese Foreign Minister Takeshi Iwaya’s public lament over Biden’s national security decision illustrates the fraying edges of a vital partnership between the U.S. and Japan. As Japan remains one of the largest investors in the U.S., such obstacles may cultivate an air of suspicion or unease within the Japanese business community.

Moreover, the repercussions of blocking the acquisition could foster reluctance among foreign investors, thereby impacting broader trade relations. The U.S. must consider how geopolitical dynamics can influence economic partnerships; thus, there is a compelling need to ensure that national security measures do not engender mistrust or retaliation from allies.

Labor and the Future of American Industry

From a labor perspective, the central question remains: what does this acquisition mean for American jobs? The narrative of protecting American workers, while crucial, must confront the realities of an evolving global market. A nimble and competitive steel industry may require partnerships that leverage international investment for modernized infrastructure and efficiency. However, the union’s resistance signals a desire to prioritize domestic control of essential industries.

As the dust settles post-litigation, stakeholders must engage in an honest dialogue about the future of American steel. Will the industry thrive through collaboration with foreign entities, or should it remain steadfastly nationalistic in its approach to stewardship? In an interconnected world, finding the right balance is imperative for both economic resilience and worker protection.

The protracted negotiation over the Nippon Steel-U.S. Steel acquisition serves as a microcosm of broader themes within U.S. business, labor, and foreign relations. The coming months will be pivotal in shaping the future landscapes of these domains, as stakeholders grapple with the intricate realities of an industry undergoing significant transformation amidst competing interests.

Leave a Reply