As the trading landscape continuously evolves, investors can benefit immensely by staying updated on critical market developments. This article highlights several key elements that are impacting the current financial environment, focusing on market movements, significant corporate occurrences, and pivotal economic indicators.

The stock market has recently displayed a notable bullish trend, particularly with the S&P 500 index achieving its fourth consecutive day of gains. Closing with an increase of 0.75%, this upward performance signals a positive sentiment among investors. The Nasdaq Composite outperformed the broader market, surging by 1% as investors returned their attention to technology stocks. Meanwhile, the Dow Jones Industrial Average added 235.06 points, reflecting a 0.58% gain. These developments come on the heels of significant economic data releases, particularly the producer price index (PPI), which provides insights into wholesale price inflation. The PPI data indicated a 0.2% rise in wholesale prices for August, aligning with market expectations and setting the stage for the upcoming Federal Reserve meeting.

Labor Movements and Market Repercussions

In an environment where production disruptions can send shockwaves through markets, recent labor actions at Boeing are noteworthy. Over 30,000 workers have initiated a strike after rejecting a tentative contract agreement with the International Association of Machinists and Aerospace Workers. This strike, labeled an “unfair labor practice strike” by IAM District 751 President Jon Holden, is particularly concerning as it threatens to halt the production of Boeing’s flagship aircraft amid the company’s ongoing recovery efforts following past challenges. Boeing has publicly reiterated its commitment to resolving employee relations and has expressed a readiness to renegotiate terms with the union.

Strikes of this magnitude can have broader implications, affecting stock performance and overall investor confidence, especially in key sectors such as manufacturing and aerospace.

Earnings reports are a critical aspect of understanding corporate health and market sentiment. Adobe, for instance, released third-quarter results that outperformed Wall Street expectations for both sales and earnings. However, despite this positive performance, Adobe’s shares declined by approximately 8% in premarket trading. The decline can be attributed to underwhelming guidance for the fourth quarter, with forecasts falling short of analysts’ projections. The company anticipated earnings per share between $4.63 and $4.68, slightly below expectations of $4.67, showcasing how even a solid earnings beat can be overshadowed by cautious outlooks.

Breakthroughs in Medical Research

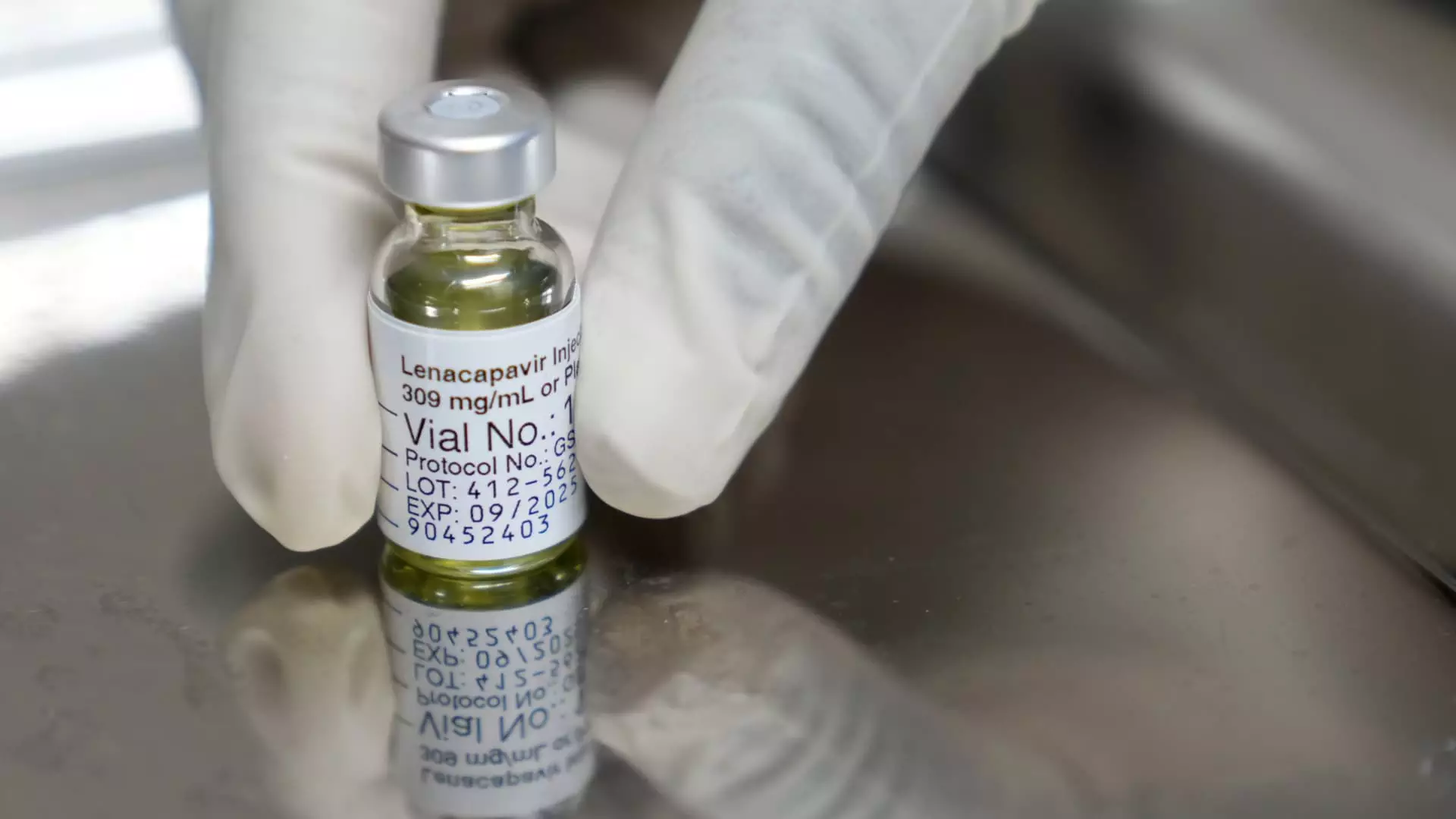

In the pharmaceutical realm, Gilead Sciences has made significant strides with its latest HIV preventive treatment, lenacapavir. The results from a large-scale trial revealed a remarkable 96% reduction in HIV infections among participants, with an astonishing 99.9% of those receiving the treatment remaining HIV-free. These findings are not only pivotal for public health but also raise expectations for U.S. Food and Drug Administration (FDA) approval for the drug. Successful approval could open new avenues for HIV prevention, reshaping how the medical community approaches this long-standing epidemic.

The realm of mergers and acquisitions continues to capture headlines, particularly the ongoing legal battle involving Tapestry, the owner of Coach, and Capri Holdings, which owns Michael Kors. Their proposed $8.5 billion merger is currently being scrutinized in a Manhattan courtroom. Following the FTC’s legal action to block the merger on grounds that it could harm competition within the handbag sector, both companies are striving to convince regulators of the benefits of their deal. This case underscores the crucial intersection of corporate strategy and regulatory oversight, as firms navigate attempts to consolidate while facing potential barriers.

Investors must remain vigilant and informed about the myriad factors influencing market movements, from labor dynamics and corporate earnings to health advancements and regulatory scrutiny in mergers. Understanding these elements will be essential in making informed investment decisions in a complex and rapidly changing financial landscape.

Leave a Reply