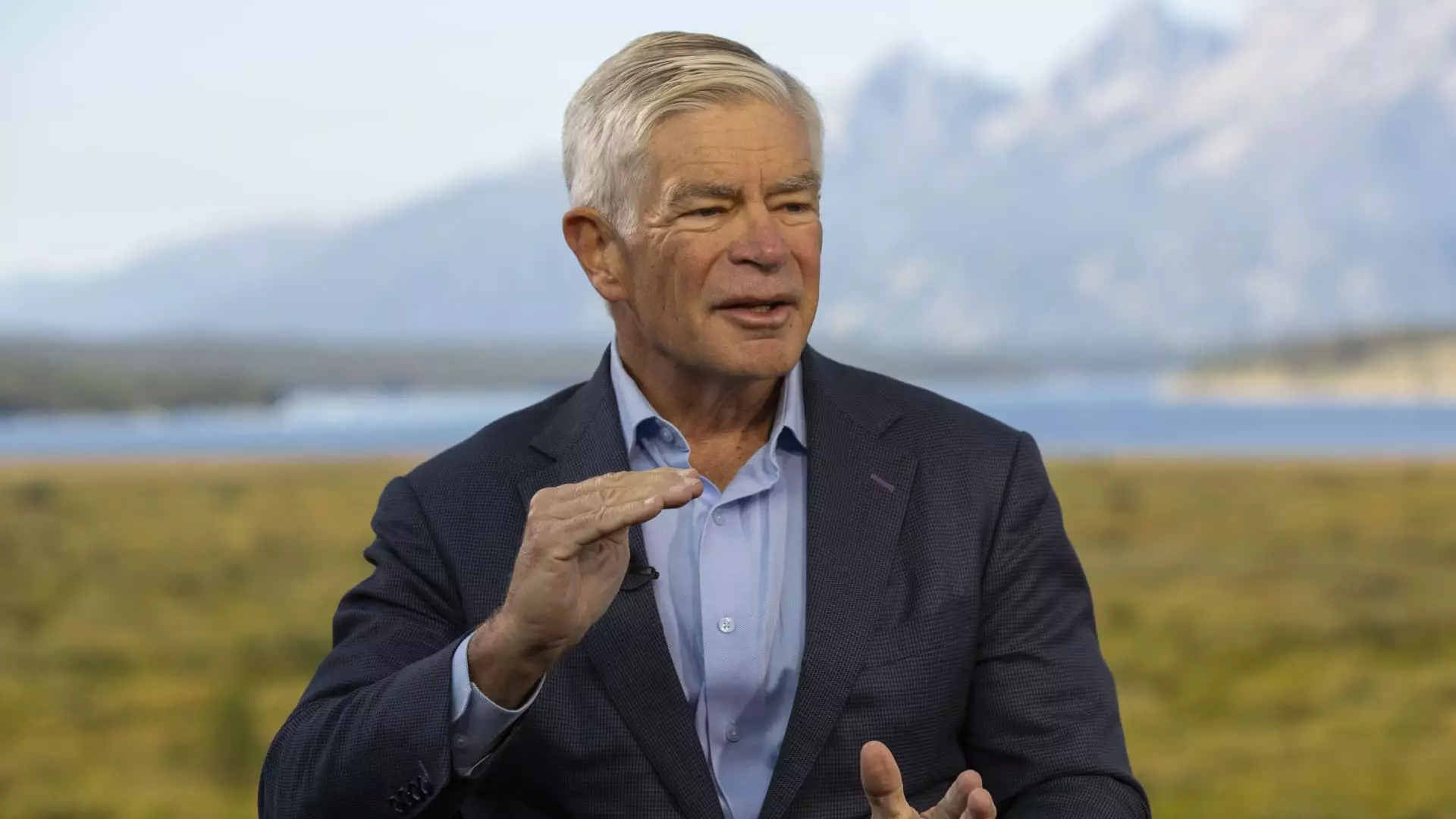

Philadelphia Federal Reserve President Patrick Harker recently gave a strong endorsement for an interest rate cut in September. This announcement comes after minutes from the last Fed policy meeting indicated that a cut is imminent. Harker emphasized the need to start the process of moving rates down and suggested that monetary policy easing is almost a certainty when officials reconvene in less than a month.

Harker highlighted concerns about potential weakness in the labor market and the need to address inflation uncertainty. He emphasized the importance of easing policy methodically and signaling well in advance to mitigate any adverse effects on the economy. With markets already pricing in a 100% chance of a quarter percentage point cut, and a 1-in-4 chance of a 50 basis point reduction, Harker acknowledged that there is still uncertainty regarding the magnitude of the rate cut.

Despite the looming presidential election, Harker reassured that policy decisions would be based on data and not influenced by political concerns. He emphasized the Fed’s role as proud technocrats whose responsibility is to analyze data objectively and respond appropriately to economic indicators. Harker expressed confidence in the Fed’s ability to make independent decisions to steer the economy in the right direction.

While Harker provided a direct endorsement for an interest rate cut, Kansas City Fed President Jeffrey Schmid offered a more nuanced perspective on future policy decisions. Schmid acknowledged the challenges posed by a rising unemployment rate and emphasized the need to monitor labor market indicators closely. Despite indications of cooling in the labor market, Schmid highlighted the importance of continued vigilance to address ongoing economic challenges effectively.

Both Harker and Schmid discussed the resilience of banks under the current high-rate environment and downplayed concerns about over-restrictive monetary policy. They underscored the importance of closely monitoring economic indicators and making data-driven decisions to support sustained economic growth. While Harker does not have a voting role in the rate-setting committee this year, his input at meetings is valued. Schmid, a nonvoter this year, will have the opportunity to vote on policy decisions next year.

Philadelphia Federal Reserve President Patrick Harker’s strong endorsement for an interest rate cut reflects growing concerns about inflation uncertainty and weaknesses in the labor market. While Harker’s call for a methodical approach to easing policy signals the Fed’s commitment to addressing economic challenges proactively, uncertainties remain regarding the magnitude and timing of the rate cut. Collaborative efforts between Fed officials and a data-driven approach to policy decisions will be essential in navigating the complex economic landscape and supporting sustainable growth in the future.

Leave a Reply